Last year Ian Thow, vice-president of Victoria, BC’s local Berkshire Investment Group branch, skipped the country and left dozens of local creditors and investors in the lurch for tens of millions of dollars. While some had wealth to spare, it’s difficult not to feel for those who mortgaged away homes and retirement savings.

However, this April, Berkshire reached confidential settlements with a good number of Thow’s victims, and continues to negotiate.

So maybe we can finally speak more frankly, without feeling as if we’re salting open wounds with personal insults.

Were these investors really only “victims”? And what was the general public’s role in this massive scam that endured for years?

On one level, it’s open-and-shut: Thow apparently told these people he’d invest their money, and instead pocketed it. He’s a criminal; everyone else a victim. That’s the story as presented, anyway.

But examining public perceptions of this prominent man over the years reveals a more unsettling picture of the complicity of everyone else.

For example, many scammed investors have repeatedly described Thow’s personality as “charming”, “warm” and “inspiring”. “He made you feel so good about having him as an investment adviser,” said one.

At the same time, they’ve described Thow’s expensive clothing, jewelry, furniture and homes, $500 bottles of wine, $1,000 cigars, private jets with gold seat-buckles, and lunchtime local commuting in helicopters.

Thow also habitually showed off his wealth in public venues, promising huge donations to prominent institutions and causes and bidding exorbitant sums at charity auctions.

So what’s my point? Evidently, long gone are the days when ordinary, responsible adults would find such extravagant waste and self-aggrandizing display unethical and revolting.

On the contrary, most were obviously blushed with pleasure to be in Thow’s rich embrace. Indeed, local media should issue confessionary apologies, like the New York Times did for its unquestioning reporting on Iraqi WMDs. Until 2005, for example, Thow was promoted frequently and favourably by over a dozen different Times-Colonist writers.

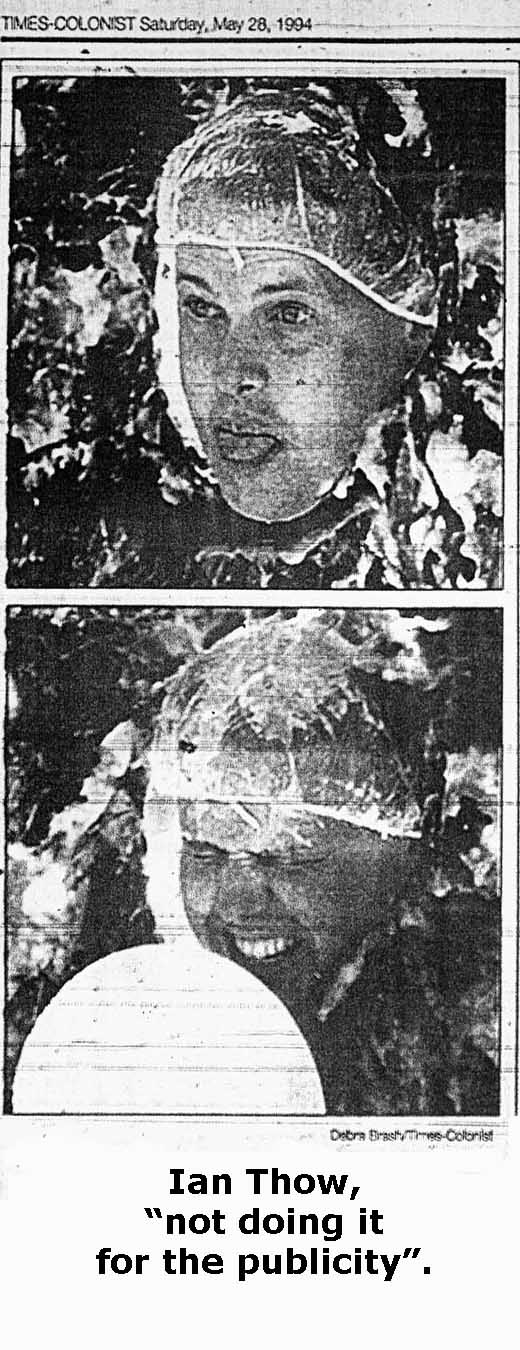

Here’s Ian Thow helping the Commonwealth Games. And here he is taking a pie in the face for children’s charity. Now he’s mingling with celebrities, raising money for a university scholarship, donating to the hospital in memory of his mother, manning phones in the TC‘s Christmas fundraiser, and serving turkey to the homeless while assuring everyone he’s “not doing it for publicity.”

Here’s Ian Thow helping the Commonwealth Games. And here he is taking a pie in the face for children’s charity. Now he’s mingling with celebrities, raising money for a university scholarship, donating to the hospital in memory of his mother, manning phones in the TC‘s Christmas fundraiser, and serving turkey to the homeless while assuring everyone he’s “not doing it for publicity.”

And ooh, check it out: Ian Thow posing in his sleek new “million dollar office” with $1,000 phones and $15,000 tables, all especially designed for highly productive, “far-sighted executives”. So it’s very fortunate that we have such executives available to provide insight on the federal government’s election-year budget: “I thought over-all it’s a good piece of work,” commented Ian Thow. (Want your vote back? Contact the TC.)

In fairness, TC archives are just the easiest to search. Such coverage is merely one aspect of our increasingly widespread tendency to ennoble and envy monetary gain, without any critical or socially-conscious faculties intervening.

And it fuels corruption. For instance, according to published figures, one of the imaginary initiatives in which Thow’s victims invested was providing loans to Vancouver developers at 10% quarterly, plus 10% “lending fees”. Well, add the numbers: Those outrageous interest rates approached 60% annually, borderline illegal. Should we really feel sorry for people whose loan-sharking scheme didn’t pan out?

Thow’s other scams were similar high-yield stings, which the investors obviously hungrily wolfed down whole without doing an iota of research. What could possibly have turned the National Commercial Bank of Jamaica into a “hot” stock worth mortgaging your house for? It’s a 170-year old institution serving a tiny island whose meager economic strengths are tourism, bauxite and illegal drugs. Since a government bail-out in 1997, the bank’s own Annual Reports could best be described as humbly, reservedly hopeful. Did the investors believe themselves illegally privy to some crucial inside information? Or had they simply not thought it through, uncaring about what impacts their enormous dollars might actually be having in impoverished, violence-riddled Jamaica?

hungrily wolfed down whole without doing an iota of research. What could possibly have turned the National Commercial Bank of Jamaica into a “hot” stock worth mortgaging your house for? It’s a 170-year old institution serving a tiny island whose meager economic strengths are tourism, bauxite and illegal drugs. Since a government bail-out in 1997, the bank’s own Annual Reports could best be described as humbly, reservedly hopeful. Did the investors believe themselves illegally privy to some crucial inside information? Or had they simply not thought it through, uncaring about what impacts their enormous dollars might actually be having in impoverished, violence-riddled Jamaica?

As much as by Thow, then, the investors were victimized by our culture’s laissez-faire standard of investing blindly through others, and by their own greed. As one couple described it, they were “happy and secure” and debt free with a “nice, lovely home”…

Yet…

They ultimately mortgaged it all into that loan scam.

Similarly, what made even some multi-millionaires chase high-yield investments? Does our greed really know no bounds?

Today, Thow is as reviled as he once was applauded. His admired personal ambition is now understood as sociopathic unscrupulousness. His luxurious lifestyle and generosity are seen for what they actually were: blatant waste, sleazy sycophancy and shameless self-promotion. His keen broker’s eye for assessing people and businesses now looks positively sinister. And scant concern for the moral issues surrounding wealth and how one obtains it suddenly doesn’t seem laudably pragmatic, but risky, cruel and destructive.

They’re important insights. But they have little value when we’re ignoring our complicity. Are we focusing criticisms on Thow because it’s too painful to behold how sycophantic and blind our own greed has become? Indeed, would we even be judging Thow harshly if he’d turned his wily arts on, say, on some cash-strapped developers or needy Jamaicans, instead of on us?

Thow was a bad investment, and courts may be the final arbiters of whether he broke the law. In the meantime, it’s much more vital to vigorously re-evaluate the kinds of behaviours in which we invest our admiration.

*

Originally published in Focus, July 2006.

*

Yes, riverrat, you read my mind. I was stunned when I read that article in the T-C about it. Here’s the link for others to see:

http://www.timescolonist.com/Bankrupt+Thow+lavish+life+financed+clients/1309360/story.html

If that stops working it can be found in the Feb. 20, 2009 Victoria Times Colonist.

I was also stunned that the journalist seemed to accept these “explanations” at face value. You’ve lost nearly a million dollars to someone and you bankroll him to the tune of $500,000 at $27,000 per month for years because you hope that will help you find the million you lost? Riiiiight.

I’m also curious about how Thow’s lawyer said he hadn’t been in hiding but had in fact been negotiating his return with authorities for a long time. A lawyer isn’t going to lie about something like that to a judge. So what would have been under negotiation?

I have absolutely no evidence, I am only speculating here, but my suspicion is that there were more people than just Thow ‘on the take’ in the original scam. And so now everyone is situating themselves as best they can to prevent themselves from being taken down, if and when Thow starts talking. Meanwhile, Thow is taking their bets on the story he’s ultimately going to tell.

Back in 2007 (in the comments above), ‘Nobody’ said, “What I find interesting is that some of the investors are apparently still bank-rolling Thow in Seattle.”

Many of us in Nanaimo are wondering about this side of the story right now, because one of our most well-known businessmen, who seems magnanimous enough to many people, is reported to have been making payments to Ian Thow even after Thow “split the scene”.

Some have suggested that this businessman was blackmailed by Thow – others prefer to believe the claims that the payments were intended as some kind of traceable line to the monies embezzled by Thow, or even as a means to enable Thow to recover those monies.

I am undecided because I lack information. Can anyone present a credible reason why this Nanaimo businessman might send many thousands of dollars a month to Thow in his exile?

One possibility, perhaps, is that Thow was merely continuing to act as an investment broker for this man, receiving monthly payments towards profitable schemes?

very interesting stuff !

i wonder about the motives of those who invested ? Big returns, tax havens?!

was there greed from all sides??!!!

i wonder about the big business types that invested??!!! very interesting story. There are many secrets that may be revealed in the coming months..

is there only one guilty party??? are there more secrets hidden in dark places?

Here’s an interesting thought. Notice the comments relating to “greed” are one-sidedly noted. Interesting. I find this whole thing enormously interesting. I feel compassion for anyone’s suffering, I do. However, it has always been in my head why the greed factor doesn’t cross over to the “victims”. Surely we (if being honest) will say that greed lead these people to the place they are now. Smart thinking perhaps as well could have had this been less an issue. I surely will be blasted for this statement, and truly I don’t care. I am just amazed that the victims have never addressed their responsibility in this. I have and I was a a victim. Move on people

Once again I bring up the need for new PJ’s. The stay will be a long one that is for sure. Or, maybe Thow’s good friend, Bill Gates will help with his defence?

Seriously, Thow is obviously mentally ill. But there is no “insanity” defence for white color fraud. Even if there was, there are no institutions to put poor Ian in. So if is off to the BIG house. Ian,meet Bubba……..

But, to quote his US lawyer, “This is a man who is going to take care of his responsibilities,”- ya right.

Whatever: It seems to me you’ve misunderstood a number of aspects of the article.

By no stretch is my article a “defence” of Ian Thow. On the contrary, it is primarily an exploration and criticism of the immense amount of public and personal praising and defending that propped Ian Thow’s greedy success up for so many years.

In fact, I don’t think Thow was all that different from Nigerian email scammers. Typical Nigerian email scams ask you to help an outgoing tyrant funnel millions of public dollars away from a poor government, or perform an absolutely simple task in return for millions of dollars from a poor country. As other writers have pointed out, these scammers, usually living in African countries which have already been thoroughly exploited by greedy western investors, have ironically found a way to exploit us back by using our own base, immoral greed against us.

I have virtually no net assets. And if you read it more carefully, you’ll see the article is a criticism of a society that often creates wealth by creating poverty in others. So if I’d lost my money to Thow, I’d have written the same article.

That said, I feel it’s good they’ve caught Ian Thow. I support honest accounting and open dialogue. I support the prospect of him having to face the people who’s money he took; they certainly deserve at the very least that.

I’d like to add something else. Your ending paragraph says “Thow was a bad investment”. This is wrong. There is a huge difference between a bad investment and fraud. A bad investment is still a legitimate investment that simply went against your speculative position. What Thow did was anything but legitimate. Pocketing peoples investments is as illegal as it comes. I just hope the courts sentence him to a long prison sentence.

Its nice to see Thow was arrested today in Oregon. It will be fantastic to finally see CRIMINAL charges laid against him.

I don’t understand how anyone can defend a criminal like him. How is he any different from the Nigerian email scammers, phishing scammers or any other fraudster? He duped people out of millions. Millions they earned justly.

I’d like to see Mr. Wipond lose 90% of his net assets and still write this story. The fact is Thow ruined a lot of peoples retirements and standard of living. Shame on Mr. Wipond for defending him.

Anonymous,

Although this is a trivial argument, I still stand behind my comments that Ian will never face true justice. The BCSC may fine him and he may be banned from trading in BC, but that will be the extent of his “punishment”.

The RCMP cannot charge someone if no witnesses come forward. It has been speculated that the true amount that Ian had “invested” was closer to $60M-$80M than the $32M the media has reported. I think the others would have said something by now if they planned to report him to the police.

Kevin Steele and others who have served time were just plain stupid.

To Nobody above:

You have forgotten that the RCMP investigation is almost complete and charges will be laid. The biggest fraud in the history of the MFDA will not likely be swept under the carpet. Recently a similar criminal was sentenced to 24 years in prison for stealing much less than Thow did. My advice to Thow is to take comfortable pj’s, it is going to be a very long sleep over. It won’t soon be put behind him as you have said but he will certainly need to watch his behind.

Chris,

Although he may very well have been a criminal, Ian Thow was smart enough to know who he could steal from. Ian will escape justice simply because those who lost the bulk of the money are not in a rush to draw the spotlight to themselves. They would rather quietly walk away then have the CRA and others start asking difficult questions.

The small investors all signed confidentiality agreements in return for their settlements so Ian will soon have put this all behind him.

Your article was balanced, and very well written.

Who cares is Illiterate! (Probably 12 years of age or grade 7 education)

Most of the people commenting on this blog are Mindless pontificators that have no life.

Oh, you mean the post from “Anon” referring to a “Lalisa Frits”? Thank you for that clarification.

FYI, so far I’ve not edited or deleted any post from this thread because it seems that people’s personal feelings, not just the ‘pure facts of the case’, are a principal aspect of this whole event and are therefore worth sharing and discussing a bit. But by all means, if there are some specific facts which you feel are demonstrably incorrect, please point them out and perhaps we can correct them here.

Rob

I was referring to ANOUN. At least refer to someone in the right context and spelling. In regards to the information posted throughout your blog, my comment was simply. Please get the facts before mindlessly wasting text. That was my point. In regards to removing my post. Feel free.

Um, “who cares”, would you like to clarify what you mean? Who’s “Alisa Fritz”? Which facts in your opinion are wrong? In the absence of clarification, I don’t see the point of these last two posts and will possibly remove them. But I’m happy to hear what you have to say.

Rob

get a life people !!!!

focus on your own problems !!!!

At least get the names right people. If you are going to mindlessly blow off steam then get the facts ok?

Alisa Fritz is her name! Classic reason facts get screwed around, dont assume the information given is always correct.I dont. Hmmm perhaps ignorance? Guess so.

Ian Thow has always been a criminal. I remember the buzz in Victoria when he abruptly left Investor’s Group. His clients should have seen this Jamaican bank scandal coming a mile away – but the market at the time was promoting a lot of greed. Hopefully enough people will learn from this.

The sad thing is that Thow seems to have eluded justice. Hiding in Seattle he is not answering to the criminal activities that he committed. I know that if I had lost money with him, I would be crossing the border with a baseball bat with the intent of taking back a pound of flesh. I’m surprised that hasn’t happened yet.

This is not done by a longshot.

The MFDA, OBSI and RCMP are all involved. Major investigations are well underway. Berkshire knows the heat that is on the way and have chosen to sell to Manulife for half the reported $ value. Manulife, a reputable firm, as shown in the way they handled the Portus nighmare, will be fair to all Berkshire / Thow victims. Pity to those who settled in mediation with Berkshire, they simply got screwed. Thow- he hurt the wrong people and he will pay dearly.

somebodyelse, Ian doesnt have the brains to write the above. I beleive it was his 2nd ex wife- LaLisa Frits

wow, this is a very interesting thread. I knew ian personally but never would have invested with him. there was just “something” about him and his ways. He was someone you didn’t get in the way of if you could avoid it. I also think that “somebody”‘s comment above is likely Ian. How very interesting and how like him to be keeping an eye on things and commenting anonymously. Its even his writing style actually. See how he shows himself as a GENIUS?

Anyway, all I wanted to say is that my heart goes out to Ian’s children, his ex wife, some who were unsophisticated investors in the extreme who trusted and paid a heavy financial and emotional price. My heart goes out to all who were affected – call it their own greed if you like, but they were only human and trusting on some level that “what is right” would prevail. In no way has “right” prevailed. Unfortunately, I cannot bring my heart to care much about Ian and his possible suffering. I don’t believe he suffers – I believe he is plotting his next move. I realize you said you didn’t want to take this to a personal level about Ian – but this is a very personal issue for a lot of people.

Word on the street is that the settlement with the investors was $.30 – $.35 cents on the dollar, hardly a princely sum given that most of the investors were the small fry in the bunch. Even then, the only reason why they got any money is because Le Chin got blindsided at a conference in Victoria and was quoted as saying he would look into the matter.

What I find interesting is that some of the investors are apparently still bank-rolling Thow in Seattle. Lots of interesting stuff with this story.

I have no doubt that’s why Berkshire’s parent company reached confidential settlements with some two dozen of the complainants so far. They knew full well they had some liability in it all. I feel like the whole article, really, is partly about them and other brokerages like them, and people’s willingness to basically “blind invest” through them.

What about Berkshire’s roll in all this?

Where was the compliance department?

Bershire knew Thow’s income and certainly knew his lifestyle. When one and one do not add up the compliance department is supposed to investigate. Why didn’t they. They knew he had jet aircraft. If you are going to examine greed, then do a thorough job. Thow as making Berkshire a bundle of money.

Thow made trades through Berkshire on both the Ontario and Albeta stock exchanges while not licensed to do so. Where was compliance?

If you are dealing with the Senior Vice President of Berkshire under trust, how is Berkshire not part of this ulgyness?

Who out there can answer the hard questions?

The stuff Ian Thow allegedly did is bad, no question! There are some truly innocent people that were hurt beyond belief. My question is this: Why doesn’t anyone put some blame on the greedy people who were looking to make the big killing; did they not know these were questionable investments ?Did they not see the warning signs???

In society, we tend to always blame one side; the people who were involved (for the most part) are guilty as well. I am not saying this is true of all investors, but a good percentage of them were greedy and stupid. They were trying to get something for nothing. They most likely saw warning signs, but decided to ignore those “gut feelings”. In the end, they were hurt. This does not excuse the “alleged behavior” of Thow. People need to look in the mirror, analyze their mistakes and take responsibility. We live in a society where no one owns up to their own personal failings. Very few of these investors were innocent (some were though). A lot were greedy and did not use their heads. They got caught up in the get rich quick aspect.

Not at all! Don’t you feel it’s better if we can truly face ourselves and how others have been affected by us, and do something, anything that might bridge the gaps? I can’t speak for any of the victims in this, but you know sometimes in even more dire, damaging situations, victims really just seek understanding and honest apologies from perpetrators. It’s like, the damage has been done, so short of rectifying it, do we ultimately want revenge or true understanding and healing?

I am assuming the last writer means put a bullet in your head.

STAND UP AND DO THE RIGHT THING IAN,IF NOT FOR YOURSELF OR THE VICTIMS THEN AT LEAST DO IT FOR YOUR CHILDREN. SHOW THEM YOU HAVE SOME SELF RESPECT LEFT.

Well Rob you called it right.

In the TC last week was the story of a US company called Vertrue acquiring a local firm named Neverblue Media. Both companies were lauded for their success and Neverblue has even won a couple of business awards.

How do the companies make money and become so successful? Well if the BBB and multiple state Attorney Generals are correct, it is by charging consumer credit cards for services they don’t use and in many cases don’t know that they have paid for.

http://www.stocklemon.com/05_23_06.html

Classic example of your last point.

I guess I’m in the end reluctant to really focus on the personal side of this. I’m most interested in the institutional aspects. Those personality traits and business practices fundamental to this situation which are in fact deeply embedded in much of our modern, western culture. As I think I said earlier — It’s ironic that, had Thow invested that money in child sweatshops and everyone had made a killing, in many people’s minds that would somehow have been more acceptable behaviour. We know that, because that’s going on even more frequently than Thow’s type of scams.

I don’t think that bipolar mania is the correct term nor do I think that we ever saw one “flash” of guilt.

The correct diagnosis in my opinion is sociopathy. There is no guilt or remorse at all. Ian Thow was smarter than those who lost money so therefore the victims deserved what they got! The victims were all greedy individuals who should have known that their investments were risky and planned accordingly.

I am sure that Ian is happy doing his own thing now in Seattle and as he mentioned to a TC reporter 9 months ago, is very suprised that this is still all an issue in Victoria!

I think Ian should get a name change to “Enron Thow”

Society, hmmmm, normal, abnormal or none of the above, common or un-common or none of the above? Scams are a common occurance, not being scammed is a common occurance….. Anyway, I could write a novel about this and in the end, just as it is in a novel I once read, that a man seeked out his treasure, travelled the World, met people everywhere, did different things, in the end, the treasure he was looking for was right where he started from….

I met Ian, once, and I agree he had flash, flash get’s the cash. I asked him to invest in a education software program for children that have stuttering problems, he never did return my calls after he said “sure, call me and we can talk about it”, well, I guess he was too busy….

I also worked with many people that were in his circle, the rich ones you know, with disposable income, not like the people who lost their shirts, and by the way, wow, it’s one thing to give the money and risk it all, it’s another for someone else to take it all knowing that well, we know the story. Anyway, back to the ones I knew, most were out the country when I let them know the guy they bragged about as being so cool and letting them use his Jet, etc., etc., was in trouble. I warned them months before the trouble, how is it possible that a guy who is nothing more than a Mutual Fund Sales Rep. could possibly have so many toys? Hmmm, they wondered for a minute but still acted as if there was nothing to worry about. Anyway, it turns out those were probably some pretty expensive plane rides. I never did find out how much or cared to find how much was lost, their business, not mine.

I worked a fund rasier with him, people called in, probably 20 or 30 that I took pledges from, they all loved him and did the same, bragged about how good he was, he was good, that night, a record was set for pledges, mostly because of Ian’s circle, good thing the money pledged couldn’t be touched, it was about 40K, a dinner and a couple bottles of wine, and yes, a cigar for Ian, ahhh, life is good.

The eyes in a person tell everything, greed clouds reason, anger clouds reason, it’s within the eyes, blinded by the flash, blinded by the cash. Greed, excitment at the possibility of more $$$, anger, man oh man, I just got taken! In the end, blind.

I have my Psych. degree, if I were to guess, I would say this was a case of Bi-Polar Mania, or Mania itself. I never did see a picture of him after the ride was over, but I’ll bet you, the sparkle was gone, and the bags of guilt showed themselves,as, well, the truth.

Every ride at the Carnival ends, so did this one.

Karl. K.

Indeed, Karl. I suspect that’s why I think most of us were putting the word “normal” in “quotation marks”. And even if we could agree on how to define it, who says being normal would be a good thing?

Generally, I try to use the word to explore what is a relatively common occurrence, versus one that is not, and therefore what we can politically conclude from that. Is it “normal” or “typical” that most North Americans today accept advertisements as a reasonable presence in our urban environment? Or, for example, was Ian Thow’s apparent behaviour in this situation an example of relatively common behaviours in our society today, or not? And if these things are in fact relatively common, then what does that say?

I’ve seen the word “normal” written within the comments many times, and I’ve heard many people say in life, “can’t you just be normal”, what is normal anymore, and who decides the true definition of the word?

There is truth within us and there is truth within in what a liar beleives is truth.

K.K.

Good article Rob.

I have a lot of sympathy for the “unsophisticated investor” who invested their money with Ian in the belief that he would invest it prudently and in line with their wishes for security vs risk. Many of the larger investors I have less concern for however. In addition to the points you mentioned, several were involved in borderline tax evasion strategies that as far as I am concerned deserved to lose their money for being so stupid.

The larger issue, in my opinion, is not how people like Ian develop, but rather how our sleepy little Victoria seems to be ripe for explotation by his types. Every year or two it seems like their is some get rick quick artist that blows through town, taking a few million dollars from people who should know better. Kevin Steele most recently comes to mind. The MO is always the same, dress like you are worth a million bucks, hang around with the Artsy crowd, and then fleece them when they are looking.

For all of the money and wealth in Victoria, I think that the basic issue remains greed and one upsmanship. Having a 50′ yacht isn’t good enough when guys like Ian have a 60′ one. When Ian then says that he can make you the money to get a larger boat then caution and due diligence get thrown to the wind.

I would like to think that we have all learned a lesson from Ian but the sad reality is that a year from now it will happen all over again with someone else.

With no disrespect to Ian’s son but it’s so much more difficult to be on the receiving end of the saying what’s done is done. It’s a pill much easier to swallow when you are not wondering how you will pay off huge student loans and helping your offspring get a start in life when they have already once been put behind the eight ball through no fault of their own. I don’t think you should feel any guilt as you were and are a child and I pray you will grow up to be an apple that falls very far from your fathers tree. We cannot choose our parents but we can use them as learning tools and I think you are wise enough to know that and kind enough to utilize it. I also think you shouldn’t read these comment especially around Christmas because you should allow yourself some happiness at this time of year you needn’t burden yourself with worries that your father has inflicted on you, you are an innocent he unfortunately is n. Do yourself a favour and just do well in life and school and become a wonderful caring, trusting father yourself, the world needs more of them. anonymous

Thanks for your comments. This discussion just keeps becoming more interesting.

It’s a good example of why Restorative Justice is such a good model. Wouldn’t it be incredible to put Ian Thow in a room with all of the people who’ve been touched by his actions, and allow everyone to speak? That, truly, might have some positive outcomes. Or do you feel Ian is beyond being able to communicate with others directly and honestly about these events?

I can’t imagine what comment above you think came from him. Unless he was also trying to disguise himself at the same time. Certainly, I welcome any opportunity to communicate directly with anyone I write about. But I don’t always seek it out; in this case, I wasn’t really writing about Ian Thow so much as about the broader phenomenon of which he and the creditors were a small part.

So how is his family doing, anyway? I’d been wondering about that. Have some stuck by him, or…? And what were the economic repercussions for you, if any? How old are his children? Feel free to email me directly instead of posting, of course. My email address is on the ‘About RW’ page.

You say he actually became MORE emotionally distant as the wealth increased? Odd, isn’t it, how money really does come with a price…

Hello Mr. Wipond, i would like to say somthing from a very differnt point of view then almost anyone else could. I am Ian Thows second son. I watched Ian evolve into the wreck site he is today. He used to be very “normal” with his day to day goals. He wanted good things for me, my sibelings and my mother. As his “job” changed so did our life style. We went from mini-vans to porches in the blink of an eye. For a while everything seemed fine, the usual working father type thing. Then we moved up the ladder to a higher class, one I did not enjoy nor “approve” of. I really did not and still do not support Ian because i never felt it nesecary. After his job steped up even more i was like an old friend to him. There is a lot i could say to bring him down ever futher but why bother. Whats done is done. My sincere appoligies must go out to the creditiors. I feel terrible for everyone whos lives are forever changed,life saveings lost etc. Through all the shit Ian delt out he and my mom managed to raise us amazingly well. A little bit off topic but i do belive that one of the comments above was written By Ian. I find your writeing for the most part acurate and very refreshing. i look forward to your response. Oh by the way, The seat belt buckles on the citation x werent real gold.

I guess what you mean here is “it is as a parent [NOT] your duty to teach your children they can have whatever their heart desires and give it to them at the expense of others.”?? Adding the “not” makes sense with the rest of what you seem to be saying.

Overall, it sounds to me like you’re mainly HOPING his type of personality is not common. And that may be the case, at least in a superficial sense, but we can’t really be sure unless we know exactly what the bank or mutual fund companies or whoever else are right now doing with any money we might have. That was one of the main points I was trying to make in the article: Ian Thow merely EXPLOITED a practice which is, in itself, highly morally dubious and often terribly destructive and sadly all-too-normal in our society today: semi-blind investing.

In fact, compared to much of what our investment dollars ordinarily do in other countries through our banks and mutual fund companies, what Thow did was relatively far less destructive. Unfortunately. I did a whole research project after I received some internal investment documents from a Canadian bank, and discovered not a single Canadian bank has virtually any moral standards whatsoever guiding their investment practices. Other than a few they’re required to have by law, like not investing in “terrorism”. That’s something, I thought, people needed to consider when objecting to where their dollars went.

Ian lived in a middle class house the only noticable luxuries were a hot tub and a kitchen with two stoves, which we excused as him having big family get togethers. In retrospect I remember getting annoyed when I heard he got a larger boat (however I never really knew how large his first boat was)and the reason I was annoyed was because I had told him to be very careful investing my money as I was the only parent that was going to be leaving my children money and helping with their education. Ian as far as I am concerned is very far from normal, in our society today, most of us as parents in the middle class are more concerned with teaching our children how to live an economical and conservative lifestyle….it is as a parent your duty, to teach your children they can have whatever their heart desires and give it to them at the expense of others. It is a disservice to your children and will leave them empty hollow people….social deviants..so to speak..which again leads me back to the person (Ian) we are so perplexed by, he is fortunately not the norm and if in fact he does become the norm, society will have a rude awakening and it will be time to start hiding your money under your mattress instead of utilizing banks and other financial institutions. I hope that answered your questions adequately.

Holy cow! Youch.

But you say you’ve learned something about how to “spot a social deviant”. What, for example? I wonder what sort of things you did see in him that are more obvious in retrospect, since you say you didn’t see any signs of his lavish lifestyle (not even, as a neighbour, of his mansion?).

And are you sure he’s a “deviant”, and not all-too-normal in our society today?

Thanks for your comments.

Ian Thow met me as a single mother living in his neighbourhood, my three children and myself babysat his children for a few years. He not only lost a good deal of my money from the sale of my house, but went behind my back when I remarried and carelessly invested my husband RRSPS he had saved since a young man and depleted those as well. We were never privy to his lavish lifestyle as we delt with him on a neighbourly manner he never lavished us with dinners etc. but certainly taught my children Leslie, Andrea and Malcolm a lesson in life they did not need to learn. I on the other, having been through divorce and bringing my children up in poverty,was a given yet another reality check in how to spot a social deviant, I will say it taught my daughters to steer clear of Men on so called white horses. Thank you Ian I’m so happy I won’t be seeing you in heaven!!!!!

Ah, I understand. I’m sorry to hear about that.

Just two thoughts: I think we’re defining “sociopath” differently. I see in some senses our entire culture is “sociopathic”, as in “a personality with an extreme lack of moral responsibility or social conscience”.

With that in mind, you’re not merely a victim of Ian Thow’s. You’re a victim of poverty in BC today, right? If we had a decent social security network, or a system that did not create extreme wealth at one end and poverty at the other, you would not be in such dire straights. There are also many other factors, but the sociopathic nature of our whole culture is clearly a major part of the problem.

I am a victim of Thowe’s who never gave him anything. My family I beleieve was “Greedy” and they lost all their money to him. I can not ask for any help from them as he has taken it all away. I struggle daily and have not had good relations with my family since this has taken place. I am the victim here as I never gave him anything, never agreed to anything but now have nothing to depend on. We all know how hard it is to live in BC with a family unless you have money. I dont and I want to thank Ian Thowe for taking many livelyhoods away with his greed. He lost his family and mnay other have too. AND FOR WHAT? I dont think he’s a sociopath – he knew exactly what he was doing. He also knows staying in seattle – we cant touch him and as soon as the law makes it so we can he will be gone. I’m a true believer in karma and he will get his I just hope I’m around to see it!

Hm, are you writing this because I was just remarking on how no one had criticized me for this piece?

I’ll assume you’re serious.

Yes, of course, I was and am personally effected by Thow’s actions. I was not an investor, but how can we all not be effected?

Actually, I do not personally conclude that Thow is a “sociopath” or a “criminal” or “crazy”. In the article I’m ultimately trying to point out how “normal” he is, and how “normal” the whole situation was. That’s what makes it all so destructive and dangerous.

And that’s why any sort of emotionalism towards any of the people involved directly, indirectly or more distantly, is in some ways inappropriate. Pity, self-pity, accusations, anger, guilt, reproachment, it’s all just so much denial and avoidance of the fact: Our system of personal financial gain has become fundamentally corrupt and destructive. And we’re all implicated in it. We need to face that, and end it.

Generally, I don’t really understand what you’re trying to say in the second half of your comments, though. Perhaps you could clarify.

Rob, very well written article. I commend you. What I have to say however is… were you personally effected by Mr. Thow’s actions? No. You were not. I think that you, and everyone else who have nothing to do with the situation should mind your own business. Sure you can call him a criminal, a crazy person whatever. But it doesnt change what has already happened. You are all so selfish … you think that ‘you’ are the only ones affected…. you know what though? What about his family, his kids and his ex-wife… as well as us who deal with the reprocussions every day. We are victims too you know… your banter does NOT help anyone, or do any good. Realize that by calling him a sociopath you are condoning his behavior. By dictionary definition a sociopath is someone that TRUTHFULLY believes that the world is out to get him or her. They feel as though everything they do is with good intentions. They are born without a sense of right and wrong.

That being said, you are all fools. Anyone that invested money with him… its your own fucking fault. Its not his.. and guess what? He can go to jail… but sociopaths are GENIUS … he will not be in there for long if he even goes at all. He will get his way out and do it again… There is no stopping.

So if you truthfully believe he is a sociopath, I would watch your back… because it aint over.

Thanks both of you for your comments!

I’m amazed at the lack of angry responses I’ve received about this article, from people who might think I’m being cruel, or who might want to defend the current ways people invest.

While I in part share that perspective on Thow you describe, Russ, at the same time, my feeling is, we’ll never kill the beast by chopping off the head. It always grows another head to replace the last one. Whatever happens to Thow, he’s still just a bit player, a tiny cog in a massive system built on greedily exploiting greed. The only solution is likely to deal with that blindness. All of which may be simply a convoluted expansion on your comment, “Caveat Emptor!”

I loved the story. While those who invested their time, admiration and money with Ian Thow may have received what they deserve, I think people like Ian should be sent to jail to protect those of us who either dont know any better, or are blinded by our own greed. Then again, does that mean all car salesmen should be sent to jail too? Caveat Emptor!

Just want to thank you for your very thoughtful and well-written article on Ian Thow in the current issue of Focus. Good journalism!

Best regards,

Diane Swanson